Insights

August 28, 2023

M&A Update August 2023

In Insights

2022 was a year with plenty of challenges for private equity and M&A as a whole:

- The growing valuations of late 2021 were stunted by the fastest-tightening cycle in 40-plus years.

- PE borrowing rates increased to double the levels at which they stood at the start of 2022 and are well into the double digits.

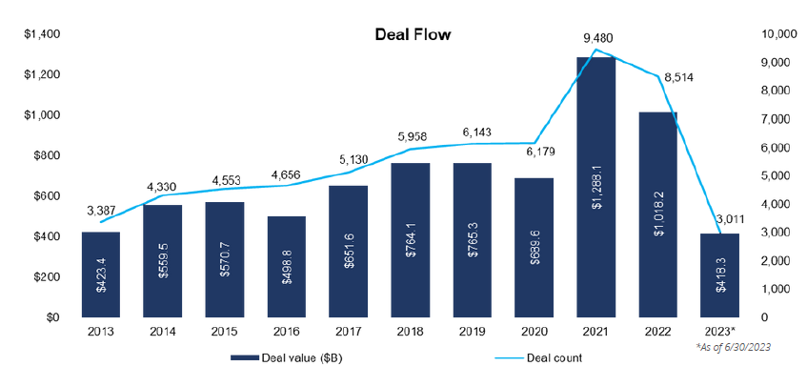

- The record deal activity we saw in 2021 was due to a variety of factors, including pent-up demand from the decline during the initial stages of the pandemic, as well as stimulus-driven activity from steps taken by the government to mitigate the pandemic’s effects.

- US PE deal making declined 19.5% for the year from 2021 highs but remained well above the quarterly pace that preceded the pandemic.

- PE firms were scrambling to find new ways to generate high returns and retain the top spot in asset class performance.

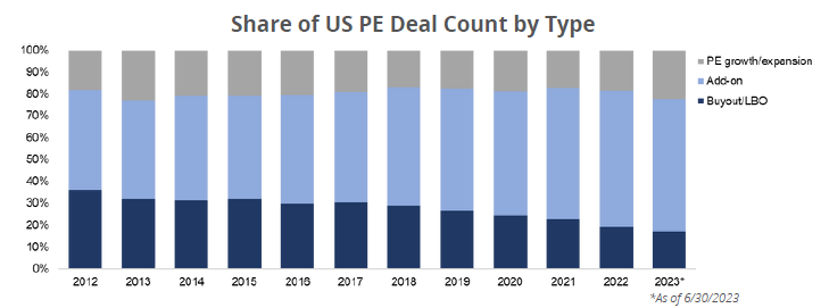

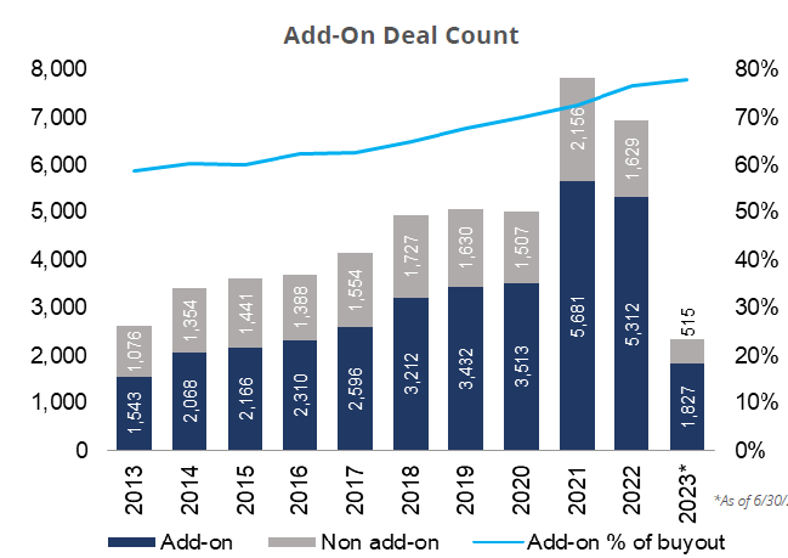

- Deals have gotten smaller, making them more doable and easier to finance, many coming in the form of add-ons.

- In the fourth quarter of 2022, total US PE deal count and value declined by 23.4% and 41.8%,respectively, from previous year peaks due to worries about the economy in 2023 and increased interest rates.

Source: Pitchbook Data

2023: Cautious Optimism

The first half of 2023 has played out in similar fashion to the back half of 2022 for USPE on many fronts. The industry continues to battle through a stubbornly high interest-rate environment that makes the cost of borrowing and servicing floating-rate debt prohibitively expensive for many deals that would otherwise get done.

- Since peaking in Q4 2021, quarterly volumes are now down 24.0% by deal count and 49.2% by deal value. Deal count is still solidly ahead of pre-COVID levels by 56.3% but only marginally so by dollar value.

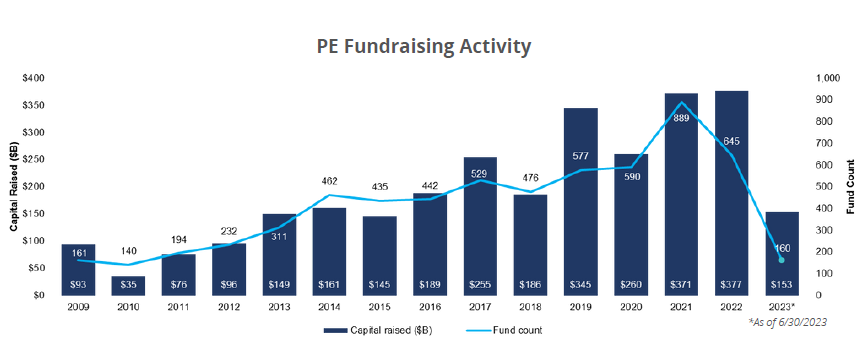

- Private equity fund performance, while still handily ahead of most asset classes and strategies on a 10-year basis, has fallen to the middle of the pack on a one-year horizon basis. As a result, fundraising continues to be more difficult and is tracking 15%-25% below 2022’s first half, although other strategies such as venture and real assets have fallen more precipitously.

- Looking through the numbers, the typical split between buyouts, add-ons, and growth equity has historically been 50/40/10 when measured by deal value, and that relationship has held. Using deal count instead, a notable uptick can be seen in add-ons and growth equity relative to buyouts. This indicates a reduction in the average size of add-on acquisitions.

Source: Pitchbook Data

Fundraising

PE fundraising activity in the first half of 2023 was 15-25% slower than last year’s pace based on the number of funds closed and final amounts of those closed funds. This slow down was widely expected given that 2022 turned into another banner year with a record $377.0 billion raised for US based PE funds.

The big surprise so far this year has been the turnaround in middle market PE fundraising. Middle market funds have accounted for 57.4% of all PE fund value closed in 2023. This is up from a 15-year low of 47.4% last year and its best level since the pandemic.

A big reason for this turnaround is that a number of traditional players in the middle markets space are raising much larger funds to go after middle market opportunities.

Source: Pitchbook Data

Add-Ons

Client sponsors have become more focused on add-on deals, because they, along with portfolio company management, are informed of potential targets and are familiar with the businesses they want to acquire. Add-ons are an effective and efficient way to average down multiples paid, build synergies, accelerate growth objectives, and reach size targets prior to exit. Generally, they also require less leverage, and financial sponsors often have more structuring flexibility to get deals closed. We expect significant add-on activity to continue through the second half of 2023.

Add-ons are at the core of the PE buy-and-build playbook, and they go up every year as a proportion of total buyouts. Historically, that increase is one or two percentage points, but in 2022, growth was off the charts. The number of add-ons as a share of total buyouts moved up nearly five full percentage points from 72.8% in 2021 to 77.7%in 2022. Add-ons have been instrumental in keeping the PE flywheel in motion during this period of market stress and we anticipate that they will remain integral in the future.

Source: Pitchbook Data

Time to Prepare

The macroeconomic conditions and tight financing markets have created a deal environment in which processes are taking longer, with more uncertain outcomes, more challenging business cases, and the need for deeper due diligence.

Buyers are feeling the pressure to justify their investment thesis and a robust business case. If they can’t also identify opportunities for value creation and quantify various outcomes, their deal may never see the light of day.

In this market, sellers cannot prepare enough. To complete a deal and avoid price reductions:

- Sellers should anticipate a greater level of scrutiny from buyers and their funding sources, they will need to be “deal ready”.

- This process can be time-consuming. A classic mistake is sellers and their bankers establishing aggressive sale timelines. These limit management’s ability to adequately plan, prepare, and optimize the business before it hits the market and, in the worst case, can cause the deal to fall through.

Buyers are paying more attention to:

- New strategic growth and value creation levers

- Business model transformation opportunities

- Technological capabilities (i.e., cloud, cyber, AI)

- Deeper data analysis

- Operating model robustness and durability

- Acquiring and retaining talent

- Roadmaps to sustainable transformation

Sellers need to prepare:

- A compelling equity story with quality supporting data

- A transformation strategy with targets and KPIs

- A detailed M&A roadmap

- New growth levers

- Cost reduction opportunities

- A technology roadmap

- A scenario analysis of upsides and risks

- An operations strategy and leverage

- A workforce strategy and metrics

- Financial and operating data to meet sustainability reporting requirements

Closing Thoughts

2023 started with a deteriorating macroeconomic outlook and market environment, highlighted by slowing growth, a sharp increase in short-term interest rates, and tightening credit and liquidity conditions, that lead to a challenging period for investors and those seeking to sell their businesses.

Despite the stagnant start the first half of the year, this climate does have the potential to provide certain opportunities. With private equity moving towards moderation, it means investors will look more favorably to smaller deals and seek to do more add-on acquisitions of quality firms in the lower and middle market.

What is the expected valuation range for your company?

Valuation ranges can vary wildly depending on any number of factors (industry, revenue/EBITDA size, concentration of customers, strength of management team, etc.). Understanding the valuation range for your company before going to market is crucial to critically analyzing offers you may receive.

What are your transition options?

A successful M&A process will often result in the highest value offers for your business but maximizing value may not be your primary objective. Understanding your objectives (value, retaining employees, quick transaction, local ownership, etc.) is vital to designing a transaction structure that meets your needs.

How to approach the market?

Thoroughly vetting prospective buyers well in advance of disclosing financial information will put you in a better position to achieve your objective. Although this approach can be more time intensive early in the process, we believe it achieves better results while minimizing the risk of disclosing confidential information about your business.

Professional Representation

A professional representative will minimize the impact on the seller while creating a viable opportunity to generate premium value through marketing, positioning, identifying the “right” buyers, and creating a competitive auction process.

Download a copy of this report here: M&A Update August 2023

Related Articles

April 7, 2025

The Rainier Group is Now Coldstream Capital Partners!

March 10, 2025

M&A Update March 2025

April 2, 2024