Insights

March 15, 2021

M&A Update February 2021

In Insights

2020 was a year with plenty of challenges and disruption; it was also a year that fostered creativity and resiliency. While we currently sit in a race between effective vaccine rollouts and another wave of the virus, the country is continuing to digest the lasting impact of the last 12months. The M&A environment has shown resilience and a strong bounce-back in both deal volume and deal size in the second half of 2020 which are all indicators to suggest this activity will continue through 2021.

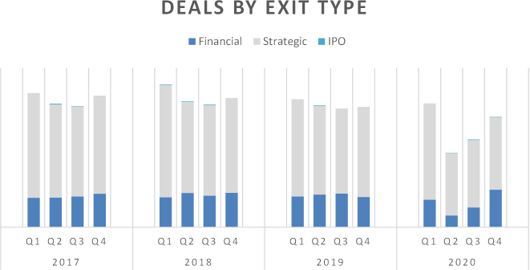

The pandemic’s effect on the M&A market was severe and immediate with both deal volume and deal size dropping immediately. While year-over-year deal volume was down each quarter, total transactions made a meaningful bounce-back in Q4. The median deal size was meaningfully higher in Q4, which suggests transactions for quality opportunities were delayed instead of shelved during the year.

One of the most notable differences driving markets now versus before the pandemic is the wider array of factors influencing both buyers and sellers. A changing political landscape, revised business models, and shifting priorities are a few key factors driving buying and selling behaviors. We continue to be inspired by the resiliency and creativity of our clients managing through a turbulent year and still better positioning their businesses for the future.

Source: Pitchbook Data

The decrease in deal volume was a direct result of the immediate response of investors, lenders, and sellers to the onset of the pandemic.

- Investors entered 2020 prepared to deploy record levels of capital. Financial buyers (PE) were quicker to pull out of the market, largely due to their use of debt financing and the uncertainty of government response to the pandemic.

- The lending markets restricted quickly with the government-regulated shutdown to many industries. Lenders have renewed their approach to evaluating opportunities, taking steps to further mitigate their downside risk through demanding stronger financials of the underlying asset, deeper due diligence, lower debt levels, and more stringent covenants.

- Sellers quickly realized a need to focus on operations to both withstand the pandemic-induced downturn and a need to stabilize before entering the M&A market.

Source: Pitchbook Data

2021: Cautious Optimism

We are beginning to see many signals to suggest a meaningful improvement in deal volume in 2021. The investors, lenders, and selling owners have a shared optimism moving into 2021, though we collectively continue to monitor the pandemic changing political landscape.

New Laws

With the Biden presidency and Democratic control of both houses, several media outlets and tax research sources are reporting on potential tax laws. Details are thin, and speculation centers on past speeches and talking points repeated during the Biden campaign. To pay for Covid-19 response, expanded health-care plans, environmental and other priorities, we expect many of the Trump-era tax changes will be undone, putting corporate and personal tax rates back to where they were under the Obama administration. Beyond that, there have been suggestions to subject wages over $400,000 to FICA taxation, and taxing long-term capital gains and qualified dividends at the ordinary income tax rate of 39.6 percent on income above $1 million.

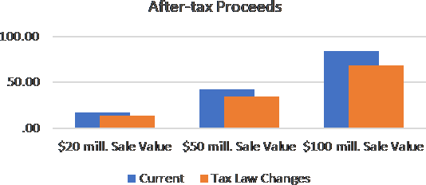

The capital gains tax is particularly concerning to owners interested in beginning a sales process. The simple example illustrates the impact of an increased capital gains rate on the sale of a $20M, $50M, and $100M business (assuming a basis of 20% of the sales proceeds).

Most tax increases are not retroactive and making rate changes mid-year are a significant tax-compliance problem. It seems most likely we would not see a change here until 2022. However, since some tax law changes and some budget-driven tax law impacts have been effective mid-year, or even retroactive to a date prior to enactment, it is possible that we’ll see higher tax rates this year.

Owners Eager to Sell

We expect a period of increased supply of sellers due to the restarting of previously delayed 2020 transactions, sellers re-entering that market that had previously postponed the process, and the addition of the “normal” seller prospects entering the market.

Private Equity: Continued Demand

Private Equity continues to have no problems sourcing financing for deals. Current estimates have fund managers looking to implement ~$273B of dry powder. Even as we see an increase in sellers the financial backing of buyers continues to outpace the supply of quality opportunities. Expect no shortage of prospective buyers and, for well-qualified selling targets, expect continued competitive bids given the healthy supply of cash relative to the opportunities available.

Strategic Acquirers: Well-Capitalized

After spending much of 2020 focusing on internal operations, corporations are flush with cash and are poised to acquire quality assets in 2021. Corporations are leveraging the lessons of the Covid-induced recession to assess their competitive positioning. Expect increased activity to address technological deficiencies or invest in disruptive technologies, acquiring assets to hedge against pandemic-susceptible business lines, and increased efforts to take advantage of efficiencies gained through synergistic acquisitions.

SPAC: Poised to Deploy Capital

The use of Special Purpose Acquisition Companies (SPAC) are on the rise and are better funded now than ever before (~90B+). These investment vehicles are essentially pools of money used to acquire assets in a specific industry. The investors in a SPAC have no knowledge of a target company when they make the investment, rather they rely on the sponsors of the SPAC with expertise in a specific industry. SPACs have a short time horizon to deploy their capital, generally 2 years, so we can expect this $90Bto be deployed rapidly.

Opening of Lending Markets

The lending markets are becoming more receptive of returning to the higher valuation levels of the past 5+ years for quality opportunities. Companies that have shown strong earnings despite the Covid-19 related regulations and restrictions are likely to receive strong lender backing.

Clarity of the New Normal

Much of the downturn for M&A activity in 2020 was related to uncertainty. As companies continue to evolve (remote work, renewed focus on automation, etc.), they continue to gain efficiencies. These gained efficiencies can be the foundation of restarting deal talks, if not the basis of higher valuations. There were also questions of logistics within the deal space – traditionally large deals required heavy face-to-face interactions as financial buyers vetted the management team and completed due diligence. 2020 proved to much of the M&A world that deals can largely be completed virtually, cutting down on many of the disruptions related to due diligence and the potential unintentional signaling of selling a business.

Distressed Assets: A typical downturn in the economy results in an influx of distressed assets into the M&A market, yet it hasn’t been as prevalent with theCovid-19 recession as many experts predicted. The lower supply of distressed assets is presumably related to government stimulus and increased lender patience. We may begin to see more distressed assets as lenders begin to lose patience and as stimulus shifts from corporate to individual welfare.

Migration: 2020 altered how we approach collaboration and efficiency in the workplace. Remote work continues to be the norm for many regions and industries and is quickly becoming a desired employment benefit for skilled workers. The anecdotal evidence of migration from super-cities to more affordable, family-friendly regions is now supported with research of industry experts like U-Haul and Zillow. It’s unlikely this shift in demographics will have a meaningful impact on super-cities, but the influx of wealth into more inland regions could have a benefit to localized companies and potentially impact regional valuations.

2021: Closing Thoughts

2021 looks to be a strong year for sellers. Pent-up demand, increasing capital available to buyers, and a continued low-interest rate environment all signal competitive bidding opportunities for prospective sellers, creating a recipe for value. The question becomes how do you secure maximum value? Even in the best M&A markets, sellers need to practice diligence in entering the market:

What is the expected valuation range of your company?

Valuation ranges can vary wildly depending on any number of factors (industry, revenue/EBITDA size, concentration of customers, strength of management team, etc.) Understanding the valuation range for your company before going to market is crucial to being able to critically analyze offers you may receive.

What are your transition options?

A successful M&A process will often result in the highest value offers for your business but maximizing value may not be your primary objective. Understanding your objectives (value, retaining employees, quick transaction, local ownership, etc.) is vital to designing a transaction structure that meets your needs.

How to approach the market?

Thoroughly vetting prospective buyers well in advance of disclosing financial information will put you in a better position to achieve your objective. Although this approach can be more time intensive early in the process, we believe it achieves better results while minimizing the risk of disclosing confidential information about your business.

What is the benefit of having professional representation?

A professional representative will minimize the impact on the seller while creating a viable opportunity to generate premium value through marketing, positioning, identifying the “right” buyers, and creating a competitive auction process.

Download a copy of this report here: M&A Update February 2021

Related Articles

April 7, 2025

The Rainier Group is Now Coldstream Capital Partners!

March 10, 2025

M&A Update March 2025

April 2, 2024