Insights

April 2, 2024

M&A Update March 2024

In Insights

2023 was a year with plenty of challenges for private equity and M&A as a whole:

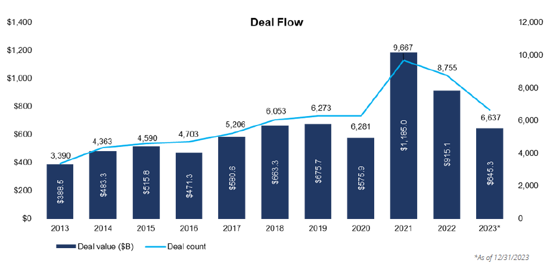

- PE capital deployed in the US declined by 29.5% on the year and value derived decreased by 26.4%

- PE borrowing rates have remained high and are still near double the levels at which they stood at the start of 2022.

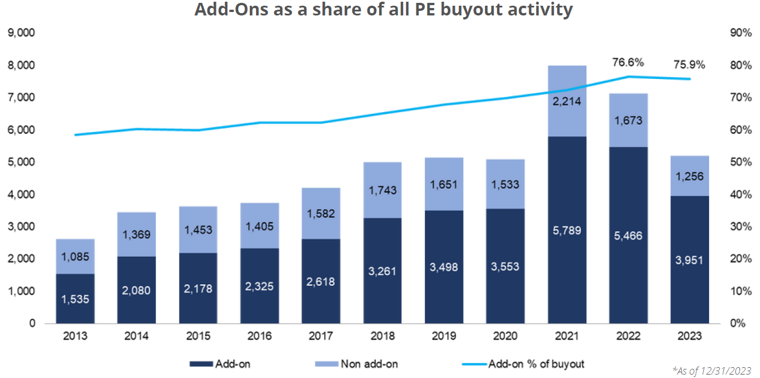

- While not as depressed as exits, buy-side activity has decreased to roughly half of 2021’s peak, with platform deals taking the brunt of the hit. Add-ons and PE growth equity rounds have filled the void, but only partially and dominated by smaller deals.

- The PE end game at present is to grow portfolio companies back up to historical values. With interest rates higher for longer, PE companies need to grow for longer.

- Across the over eleven thousand US companies currently held by PE owners, the median holding period has stretched to 4.2 years and continues to grow.

- Deals have gotten smaller as these types of deals are more easily closed and easier to finance, many coming in the form of add-ons.

Source: Pitchbook Data

2024: Cautious Optimism

2023 has played out in similar fashion to the back half of 2022 for US PE on many fronts. The industry continues to battle through a stubbornly high interest-rate environment that makes the cost of borrowing and servicing floating-rate debt prohibitively expensive for many deals that would otherwise get done.

That said, we believe we can look into 2024 with cautious optimism for the following reasons:

- While deal flow has certainly taken a hit in the last two years, it can also be looked at as returning to normal levels prior to 2020. 2021 saw record deal flow due to pent up demand brought on by the COVID pandemic. The 2023 total deal value and count are on par with 2019.

- The US economy has shown resiliency and not taken quite the hit that was forecast at the start of the year. Economic activity is returning to sustainable levels as higher interest rates tame inflation. We believe this easing is creating the conditions for likely rate cuts in 2024. Labor markets have showed signs of normalization at the end of 2023 and unemployment rates are estimated to remain low in historical context.

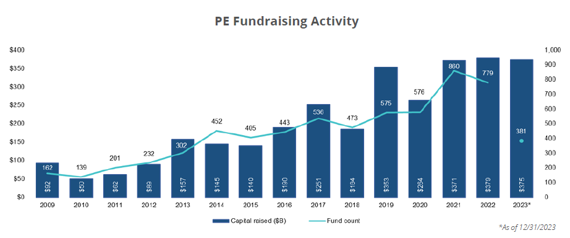

- 2023 was another great year for PE fundraising, especially for middle-market focused funds. With the record high dry powder levels and an increased desire for smaller deals we believe there will be great opportunities for smaller middle-market companies.

- Add-ons once again played a huge role for PE firms, accounting for 75.9% of all PE buyouts. This is slightly down from last year, yet still near a historic peak. Add-ons are integral in enabling PE platforms to progressively expand and enhance their market position, especially amid challenging market conditions.

Fundraising

Fundraising has been the one bright spot over the past two years. Slower deployment amid robust fundraising means that dry powder continues to build, swelling by 9.3% in the past two years to a new record high of $955.7 billion.

Middle-market managers followed up their best-ever fundraising years in 2021 and 2022 with a strong 2023. They closed 205 funds worth an aggregate value of $180.6 billion. Despite a challenging fundraising landscape, total capital raised in 2023 showed resilience, finishing just below 2022.

Large-fund fatigue has begun to set in, and as a result, investors have started to gravitate more toward smaller funds that focus on smaller deals.

Source: Pitchbook Data

Add-Ons

Client sponsors have become more focused on add-on deals, because they, along with portfolio company management, are informed of potential targets and are familiar with the businesses they want to acquire. Add-ons are an effective and efficient way to average down multiples paid, build synergies, accelerate growth objectives, and reach size targets prior to exit. Generally, they also require less leverage, and financial sponsors often have more structuring flexibility to get deals closed.

Add-ons continue to play a big role in the PE landscape, especially with recent market dynamics. For the full year of 2023, add-ons maintained a substantial presence, accounting for 75.9% of all PE buyouts. This is only slightly lower than 2022 and remains near a historic peak.

Source: Pitchbook Data

Time To Prepare

The macroeconomic conditions and tight financing markets have created a deal environment in which processes are taking longer, with more uncertain outcomes, more challenging business cases, and the need for deeper due diligence.

Buyers are feeling the pressure to justify their investment thesis and a robust business case. If they can’t also identify opportunities for value creation and quantify various outcomes, their deal may never see the light of day.

In this market, sellers cannot prepare enough. To complete a deal and avoid price reductions:

- Sellers should anticipate a greater level of scrutiny from buyers and their funding sources. They will need to be “deal ready”.

- This process can be time-consuming. A classic mistake is sellers and their bankers establishing aggressive sale timelines. These limit management’s ability to adequately plan, prepare, and optimize the business before it hits the market and, in the worst case, can cause the deal to fall through.

Buyers are paying more attention to:

- New strategic growth and value creation levers

- Business model transformation opportunities

- Technological capabilities (i.e., cloud, cyber, AI)

- Deeper data analysis

- Operating model robustness and durability

- Acquiring and retaining talent

- Roadmaps to sustainable transformation

Sellers need to prepare:

- A compelling equity story with quality supporting data

- A transformation strategy with targets and KPIs

- A detailed M&A roadmap

- New growth levers

- Cost reduction opportunities

- A technology roadmap

- A scenario analysis of upsides and risks

- An operations strategy

- A workforce strategy and metrics

- Financial and operating data to meet sustainability reporting requirements

Closing Thoughts

In 2023 we experienced a deteriorating macroeconomic outlook and market environment, highlighted by slowing growth, a sharp increase in short-term interest rates, and tightening credit and liquidity conditions, that lead to a challenging period for investors and those seeking to sell their businesses.

The macroeconomic tides appear to have begun to turn toward more favorable conditions, but the echoes of 2023 remain. This climate does have the potential to provide certain opportunities. The trend toward caution in private equity continues, meaning investors will continue to look more favorably at smaller deals and seek to do more add-on acquisitions of quality firms in the lower and middle market.

What is the expected valuation range for your company?

Valuation ranges can vary wildly depending on any number of factors (industry, revenue/EBITDA size, concentration of customers, strength of management team, etc.). Understanding the valuation range for your company before going to market is crucial to critically analyzing offers you may receive.

What are your transition options?

A successful M&A process will often result in the highest value offers for your business but maximizing value may not be your primary objective. Understanding your objectives (value, retaining employees, quick transaction, local ownership, etc.) is vital to designing a transaction structure that meets your needs.

How to approach the market?

Thoroughly vetting prospective buyers well in advance of disclosing financial information will put you in a better position to achieve your objective. Although this approach can be more time intensive early in the process we believe it achieves better results while minimizing the risk of disclosing confidential information about your business.

What is the benefit of having professional representation?

A professional representative will minimize the impact on the seller while creating a viable opportunity to generate premium value through marketing, positioning, identifying the “right” buyers, and creating a competitive auction process.

Download a copy of this report here: M&A Update March 2024

Related Articles

April 7, 2025

The Rainier Group is Now Coldstream Capital Partners!

March 10, 2025

M&A Update March 2025

August 28, 2023