Insights

March 10, 2025

M&A Update March 2025

In Insights

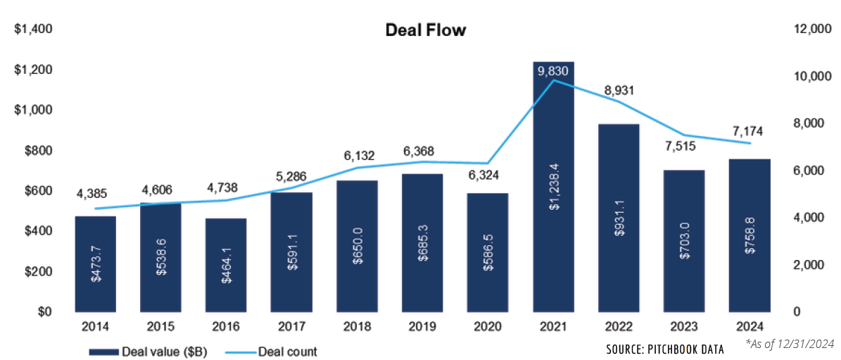

After a challenging 2022 and 2023, 2024 marked a significant rebound in global M&A activity, with total deal value rising as macroeconomic conditions stabilized, even as deal volume declined. Valuations found firmer footing, and capital markets reopened for deal-making, leading to a double-digit increase in total PE deal value YoY. While overall transaction count decreased, a more disciplined deal environment and an emphasis on quality over quantity helped support market recovery.

- Global M&A rebounded strongly – Deal value reached $3.71 trillion across 45,191 transactions, reflecting a 19.1% YoY increase in deal value, as more favorable economic conditions supported deal-making.

- North America led the charge – The region saw $2 trillion in M&A deal value across 17,509 deals, marking a 16.4% YoY increase in value and 9.8% growth in deal count. The market benefited from easing inflation expectations and lower interest rates.

- Valuations stabilized, with room to grow – The median EV/EBITDA multiple settled at 8.8x,slightly below 2023’s 9x, signaling a return to mid-cycle norms. However, the public-private valuation gap remains wide, leaving room for private multiples to expand in 2025.

With interest rates likely to decline, valuation gaps narrowing, and capital markets reopening, the building blocks are in place for a more active M&A market in 2025. However, geopolitical risks, regulatory scrutiny, and public-private valuation gaps remain key factors to watch as the year unfolds.

Source: Pitchbook Data

2025: Cautious Optimism

Much like 2023, the past year presented challenges for dealmakers, but 2024 demonstrated the resilience of the M&A market despite macroeconomic headwinds. While high borrowing costs and valuation mismatches kept PE deal-making below peak levels, overall M&A activity rebounded, signaling that the worst of the slowdown may be behind us.

However, rising trade tensions and new tariff policies could introduce additional uncertainty in 2025, particularly in industrial and manufacturing sectors. Looking ahead to 2025, we maintain cautious optimism for several key reasons:

- M&A activity has stabilized at sustainable levels – While 2021’s record-setting deal flow was an anomaly driven by post-pandemic demand, 2024’s deal count and value indicate a return to pre-pandemic norms rather than a prolonged downturn. Lower volatility, stabilized valuations, and more predictable economic conditions should provide a healthier environment for transactions in 2025.

- Economic conditions are improving – The US economy avoided a severe downturn, and inflation has continued to ease. Labor markets remain strong, and the Federal Reserve’s signals of potential rate cuts in 2025 could reignite deal-making momentum, particularly in interest-rate-sensitive sectors like PE and leveraged buyouts (LBOs).

- PE firms are ramping up capital deployment – Dry powder levels declined in 2024, as GPs accelerated capital deployment amid narrowing valuation gaps. Middle-market PE funds outperformed in fundraising, while larger buyout funds faced headwinds. If rate cuts continue in 2025, we could see a resurgence in sponsor-backed M&A.

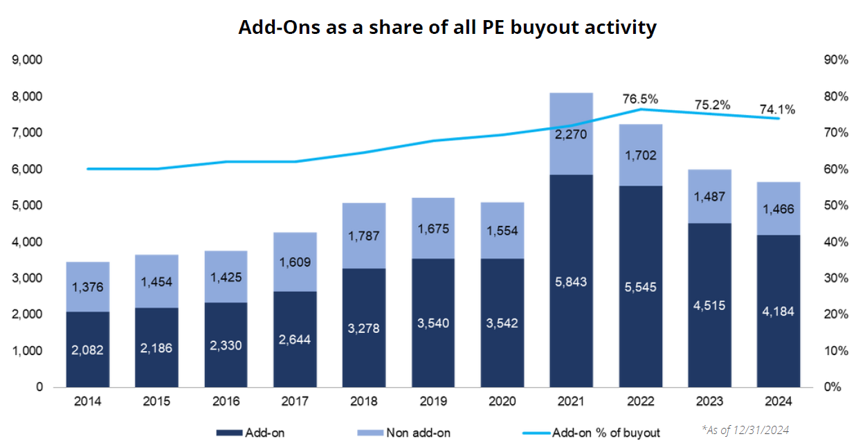

- Add-ons remain a cornerstone of PE strategy – 74.1% of all PE buyouts in 2024 were add-ons, reflecting their importance in sponsor-backed M&A. However, with lower interest rates improving financing conditions, 2025 may see a shift toward more platform LBOs, though add-ons will remain a key tool for scaling existing investments.

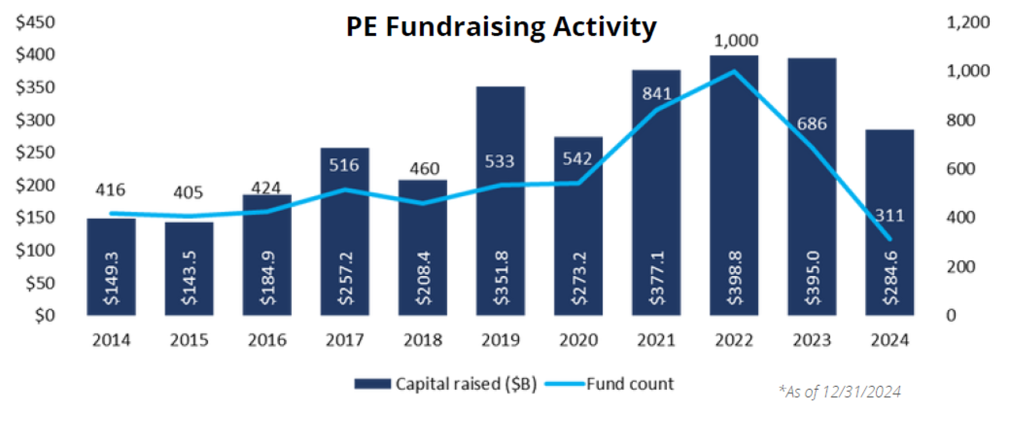

PE Capital Deployment Accelerates Amid Shifting Fundraising Trends

After years of accumulating capital, private equity firms ramped up deployment in 2024, leading to a decline in dry powder as GPs found more opportunities to put capital to work. While fundraising activity slowed, particularly among large buyout funds, middle-market funds demonstrated resilience, securing commitments from LPs eager to back smaller, more flexible strategies.

Heading into 2025, several tailwinds could revitalize PE fundraising. The Federal Reserve’s 100bps rate cuts in 2024 have already lowered financing costs, which could lead to an increase in leveraged buyouts and more sponsor-backed M&A activity. As valuations stabilize and LPs see stronger exit activity, new fundraising cycles may gain momentum.

Additionally, private credit has emerged as a key enabler of deal flow, providing alternative financing solutions as traditional bank lending remained constrained. More PE sponsors are tapping non-bank lenders to finance acquisitions, a trend that is expected to persist into 2025 as firms seek creative capital structures.

While the fundraising landscape continues to evolve, the shift from capital preservation to capital deployment is a strong indicator of renewed confidence in the PE market. With better financing conditions, stabilizing valuations, and increased exit activity, 2025 is poised to be a year of greater deal-making momentum and fresh capital commitments.

Source: Pitchbook Data

Add-On Acquisitions: A Dominant but Evolving Strategy

Private equity firms continued to lean heavily on add-on acquisitions in 2024, with 74.1% of all PE buyouts structured as bolt-ons. This trend reflects sponsors’ focus on enhancing existing platforms rather than pursuing large, high-multiple standalone acquisitions, particularly in an environment of elevated financing costs and valuation mismatches.

While add-ons remain a cornerstone of PE deal flow, lower interest rates in 2025 may begin to shift deal-making dynamics. With financing conditions improving, more platform LBOs are expected to return, potentially leading to a slight normalization of add-on activity. However, the benefits of scalability, operational efficiencies, and faster integration mean add-ons will continue to be a critical tool for value creation.

Source: Pitchbook Data

Trade & Tariffs: A Looming Risk for 2025

While macroeconomic conditions have improved, rising trade tensions and new tariffs present a major challenge for dealmakers heading into 2025. Several significant tariff increases are scheduled to take effect, creating uncertainty across key industries.

- Imminent Tariffs & Trade Policies: A 25% tariff on steel and aluminum takes effect in March 2025, with proposed 25% tariffs on autos, semiconductors, and pharmaceuticals. Additionally, broader blanket tariffs on goods from China, Canada, and Mexico are expected in April 2025, further pressuring supply chains.

- Industries Most Exposed: Sectors heavily reliant on international supply chains, such as manufacturing, industrials, technology, and pharmaceuticals, are expected to feel the sharpest impact. Rising costs and trade restrictions could slow investment and complicate cross-border M&A.

- Impact on M&A Activity: Uncertainty around input costs, supply chain disruptions, and geopolitical tensions may delay transactions, particularly for companies with significant international exposure. Cross-border deals and PE rollups reliant on global suppliers face increased risks.

- Strategic Adjustments & Potential Opportunities: Companies that proactively adapt their supply chains and invest in domestic production may be well-positioned for growth. Additionally, these tariffs could drive consolidation in affected industries, as firms seek to mitigate cost pressures through scale and synergies.

As 2025 unfolds, dealmakers will need to assess geopolitical risks carefully, factoring in evolving trade policies when structuring transactions. While challenges remain, firms that navigate this uncertainty strategically may uncover new opportunities amid shifting global trade dynamics.

Time To Prepare

The macroeconomic conditions and tight financing markets have created a deal environment in which processes are taking longer, with more uncertain outcomes, more challenging business cases, and the need for deeper due diligence.

Buyers are feeling the pressure to justify their investment thesis and a robust business case. If they can’t also identify opportunities for value creation and quantify various outcomes, their deal may never see the light of day.

In this market, sellers cannot prepare enough. To complete a deal and avoid price reductions:

- Sellers should anticipate a greater level of scrutiny from buyers and their funding sources. They will need to be “deal ready”.

- This process can be time-consuming. A classic mistake is sellers and their bankers establishing aggressive sale timelines. These limit management’s ability to adequately plan, prepare, and optimize the business before it hits the market and, in the worst case, can cause the deal to fall through.

Buyers are paying more attention to:

- New strategic growth and value creation levers

- Business model transformation opportunities

- Technological capabilities (i.e., cloud, cyber, AI)

- Deeper data analysis

- Operating model robustness and durability

- Acquiring and retaining talent

- Roadmaps to sustainable transformation

Sellers need to prepare:

- A compelling equity story with quality supporting data

- A transformation strategy with targets and KPIs

- A detailed M&A roadmap

- New growth levers

- Cost reduction opportunities

- A technology roadmap

- A scenario analysis of upsides and risks

- An operations strategy

- A workforce strategy and metrics

- Financial and operating data to meet sustainability reporting requirements

2025: Closing Thoughts

After two years of uncertainty, 2024 marked a turning point for M&A, with deal-making regaining momentum amid stabilizing valuations and improving macroeconomic conditions. While higher borrowing costs, regulatory scrutiny, and trade uncertainty remain challenges, the Fed rate cuts and a more predictable economic backdrop have set the stage for a stronger 2025.

Despite a more favorable deal environment, caution remains a defining theme for private equity and strategic acquirers alike. Sponsors continue to prioritize smaller, lower-risk transactions, with add-on acquisitions playing a central role in portfolio expansion strategies. Meanwhile, LPs are pushing for liquidity, fueling a stronger exit pipeline and renewed confidence in the market.

At the same time, rising trade tensions and new tariffs could introduce additional complexities for certain industries, particularly in manufacturing, industrials, technology, and healthcare. Deal makers will need to evaluate geopolitical risks and supply chain pressures carefully as they structure transactions.

If macroeconomic conditions continue to improve, 2025 could mark the full return of a more active and dynamic M&A landscape. However, disciplined deal-making, strategic capital deployment, and adaptability to evolving trade policies will remain essential in navigating the market ahead.

What is the expected valuation range for your company?

Valuation ranges can vary wildly depending on any number of factors (industry, revenue/EBITDA size, concentration of customers, strength of management team, etc.) Understanding the valuation range for your company before going to market is crucial to being able to critically analyze offers you may receive.

What are your transition options?

A successful M&A process will often result in the highest value offers for your business but maximizing value may not be your primary objective. Understanding your objectives (value, retaining employees, quick transaction, local ownership, etc.) is vital to designing a transaction structure that meets your needs.

How to approach the market?

Thoroughly vetting prospective buyers well in advance of disclosing financial information will put you in a better position to achieve your objective. Although this approach can be more time intensive early in the process, we believe it achieves better results while minimizing the risk of disclosing confidential information about your business.

What is the benefit of having professional representation?

A professional representative will minimize the impact on the seller while creating a viable opportunity to generate premium value through marketing, positioning, identifying the “right” buyers, and creating a competitive auction process.

Download a copy of this report here: M&A Update March 2025

Related Articles

April 7, 2025

The Rainier Group is Now Coldstream Capital Partners!

April 2, 2024

M&A Update March 2024

August 28, 2023